Gold and Silver Technical Levels and Analysis

- Gold lifts on reduced expected volatility – favouring range bound setups

- Silver’s bearish pennant invalidation, upside limits identified

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Gold Lift on Reduced Expected Volatility

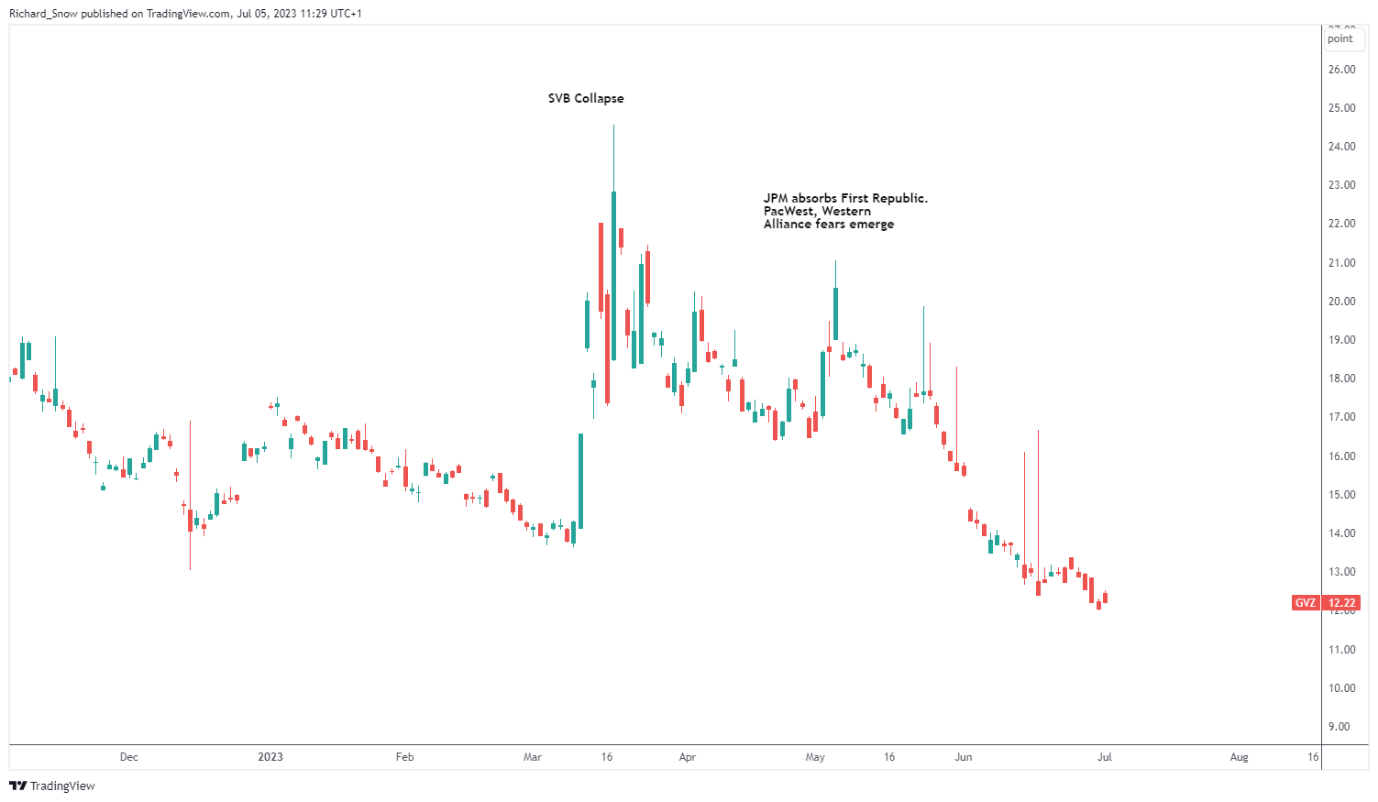

Expected 30-day gold volatility continues to track lower at a time when gold prices have lifted off the swing low seen at the end of June. Lower volatility typically favours range-bound trading conditions as the market lacks the sustained momentum to break out of a period of consolidation in search of a new direction.

Gold Volatility via the Gold Volatility Index (GVZ)

Source: TradingView, prepared by Richard Snow

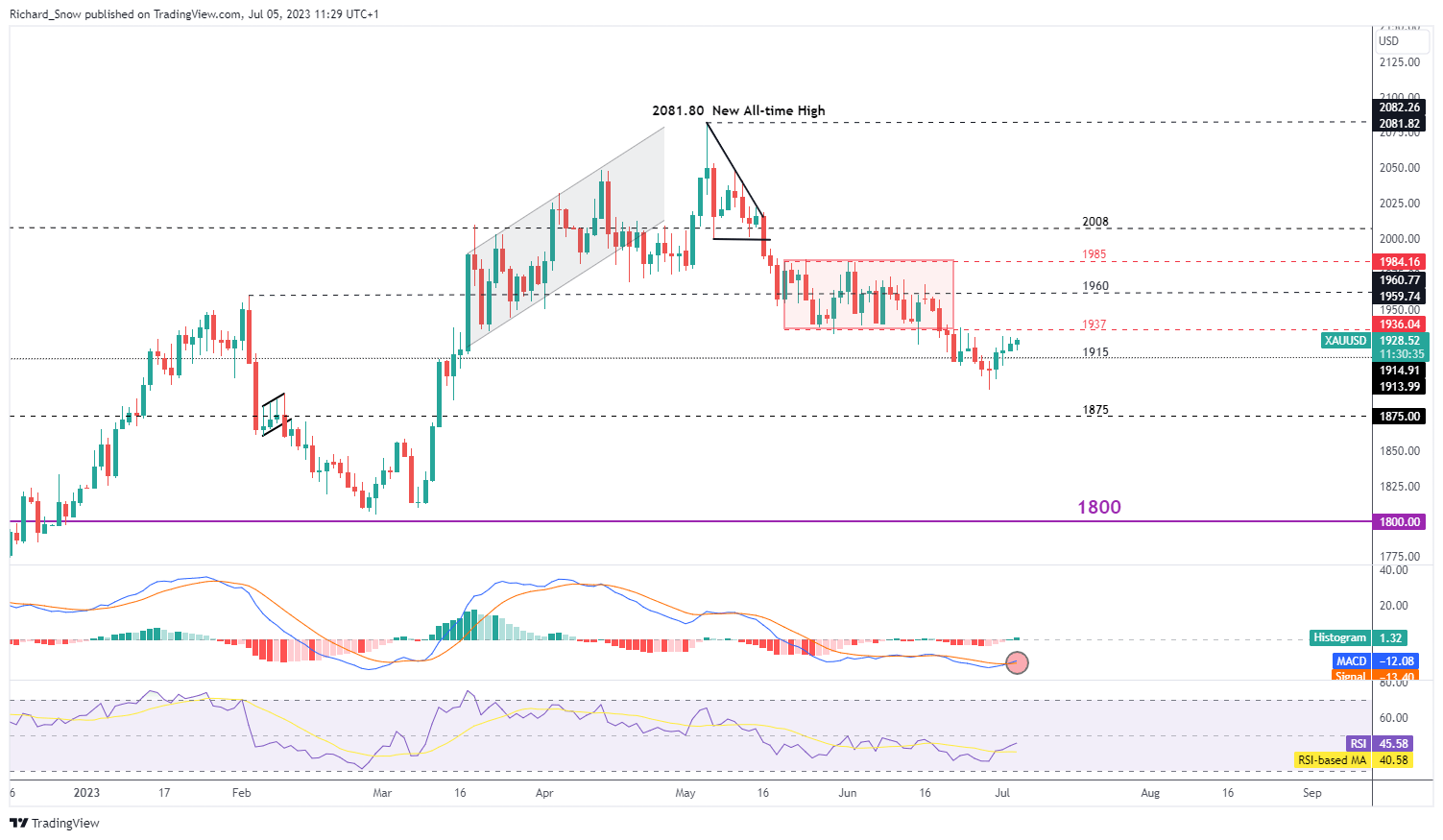

Gold Bulls Attempt a Recovery

Gold bulls have been out of favour since reaching the new all-time high in May this year, with prices falling around 9% to the recent swing low. Further hawkish interest rate guidance from the Fed threatens see bring about higher interest rates in the US, something the market is already pricing in more and more. Markets have been lagging the Fed, anticipating that market stresses will lead to downward revisions on the interest rate front.

However, US economic data has held up rather well. Last week, a surprise upward revision to the final GDP growth print suggests that the economy is performing well on a relative basis. Furthermore, the job market continues to show its resilience as companies remain motivated to hold onto staff in the fear of not finding suitable replacements.

Gold approaches the prior support level for the channel of consolidation between 1937 and 1985. It is here that bears may look for signs of a test and reversal of the recent bullish recovery. As interest rates rise, gold loses appeal as it is not a yield bearing investment, pushing up the opportunity of holding gold.

1937, can also be viewed as a tripwire for a bullish extension where 1985 would ultimately be seen at the next level of resistance for the precious metal. The MACD suggests that momentum is on the side of the recovery here but once again, 1937 remains key.

Daily Gold (XAU/USD) Chart

Source: TradingView, prepared by Richard Snow

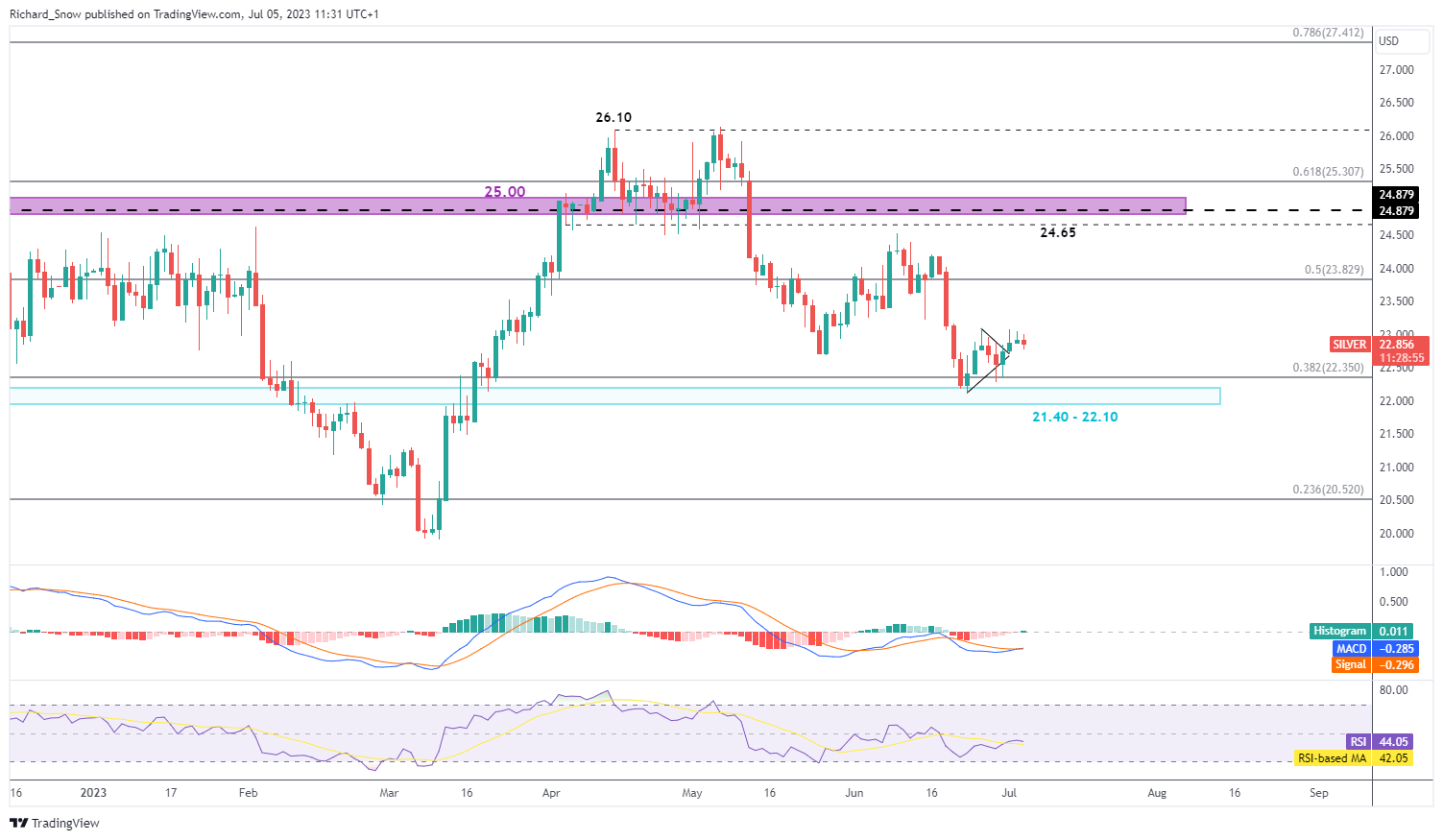

Silver Breaks out of Pennant Formation

Silver has more of a bullish feel to it given the recent break above what appeared to be a pennant formation. The pennant formation typically leads to bearish continuation scenarios but the invalidation of such a move is playing out right now.

Bullish momentum has been unconvincing thus far, with prices appearing to struggle to trade convincingly above 23.10 – the high point of the pennant. Bullish targets could be considered around 23.83 before 24.65 comes into focus.

The 38.2% Fibonacci retracement of the 2021-2022 major move at 22.35 comes into view for bears should the metal test 23.10 before heading lower.

Daily Silver (XAG/USD) Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX