EUR/USD ANALYSIS

- EZ fundamentals create concern for euro bulls.

- Will upcoming US data support bearish bias?

- EUR/USD trading at key inflection point.

EURO FUNDAMENTAL BACKDROP

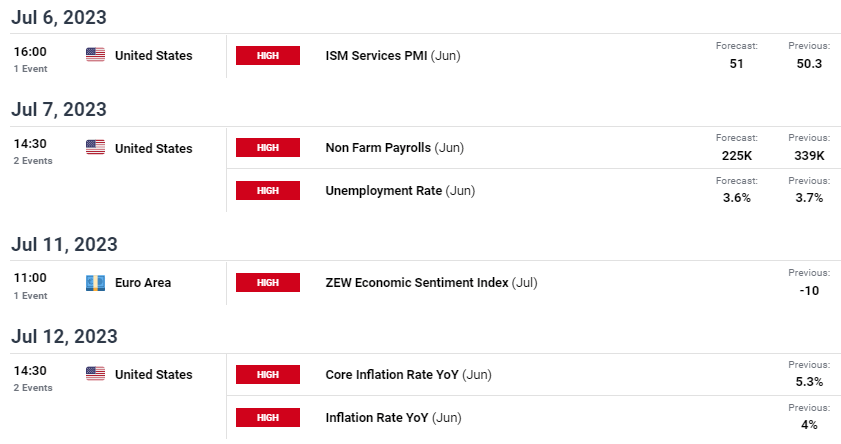

The euro has been under pressure since late June with the latest PMI data showing a slowing eurozone economy as China becomes less reliant on key manufacturing process. Over the next week, the primary driver for the pair will come via US centric data (see below) including the ISM services and Non-Farm Payroll (NFP) releases. Both of which are expected to show some resilience in the US economy and could supplement the technical pattern unfolding on the EUR/USD daily chart.

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

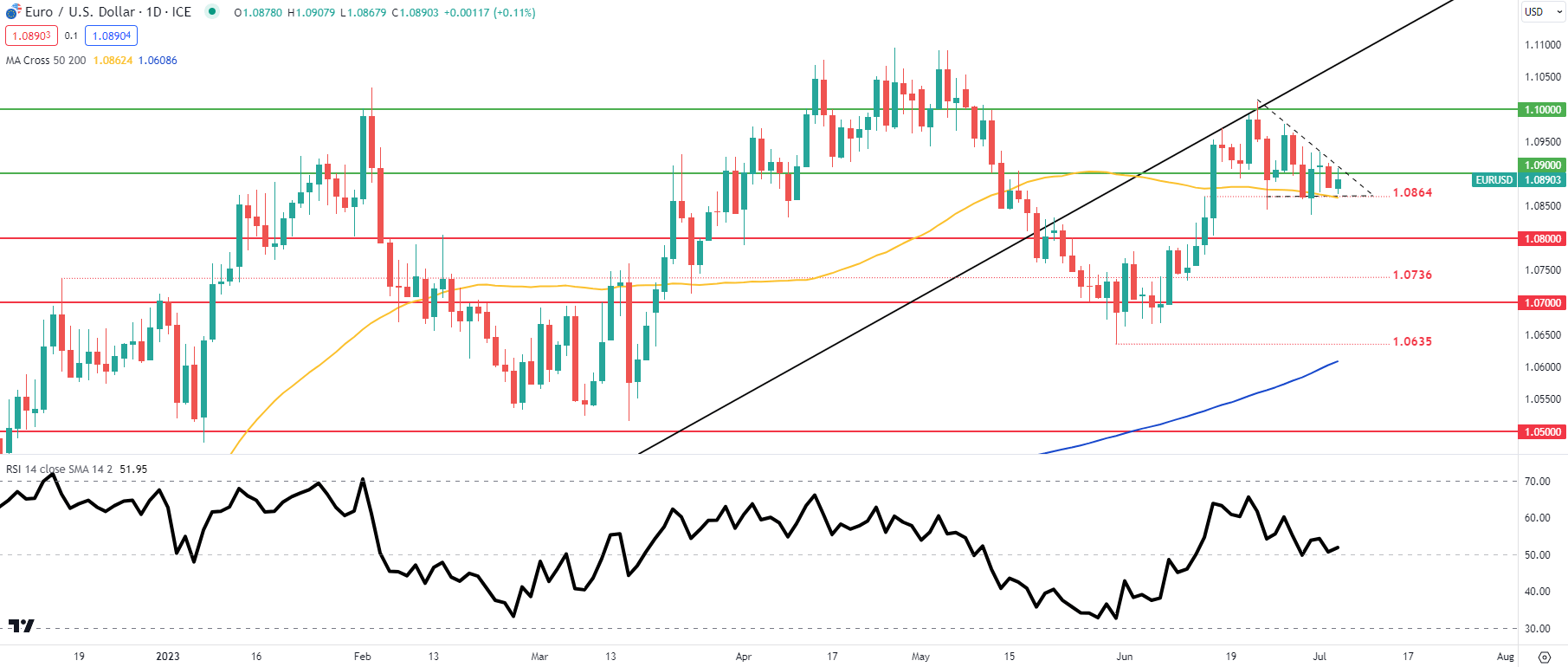

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action is currently contained within a descending triangle pattern (dashed black line) with the 50-day moving average augmenting triangle support. Traditionally, this pattern points to impending downside and a daily candle confirmation break below this support zone could see the formation unfold as expected. This would open up the possibility of a leg lower towards the 1.0800 psychological handle.

From a bullish perspective, a breakout above 1.0900 coinciding with triangle resistance would likely invalidate the bearish bias whereby a resumption of the medium-term uptrend could take place.

Resistance levels:

- 1.1000

- 1.0900/Triangle resistance

Support levels:

- 1.0864/50-day moving average (yellow)/Triangle support

- 1.0800

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 51% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas