Bearish USD/CAD - Q3 Top Trade Opportunity:

- USD/CAD has fallen below key support.

- Improving risk appetite and stimulus from China bode well for CAD.

- USD/CAD could fall further in coming weeks/months.

The Canadian dollar's rise against the US dollar above key resistance points to further gains on improving risk appetite amid resilient global growth, signs of a turnaround in commodity prices, and hopes of more stimulus from China.

Commodity prices (using the Bloomberg Commodity Total Return Index) rebounded sharply in the week ended June 16, while the Bloomberg Industrial Metals index appears to have found a floor. The rebound in commodity prices has aided commodity-sensitive currencies, including the Canadian dollar, the Australian dollar, and the New Zealand dollar.

Moreover, the raising of the US debt ceiling, fading stress in the banking/financial sector, resilience in global growth, and hopes that global interest rates are peaking have boosted investor confidence in risk-sensitive assets, especially technology stocks.

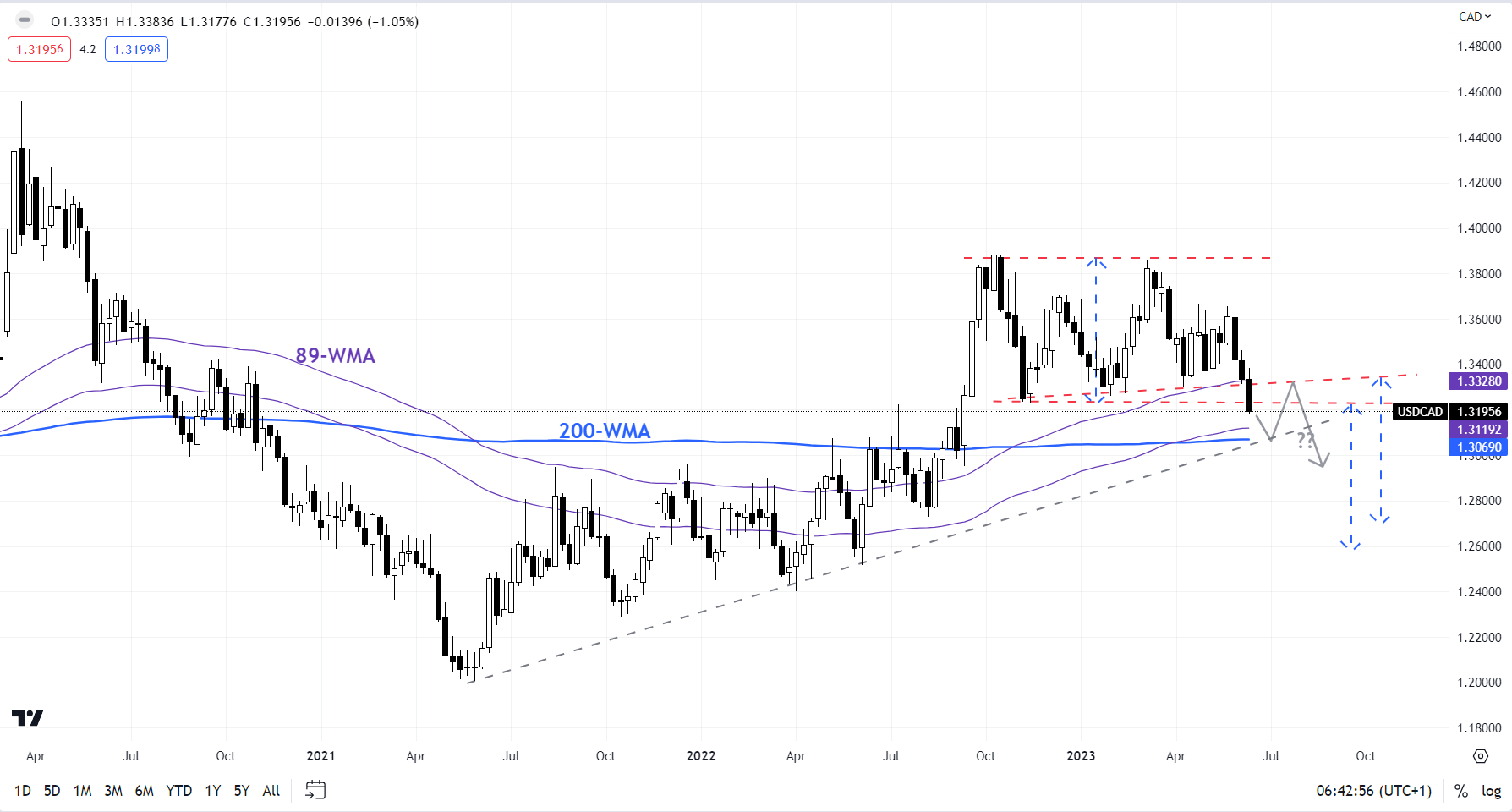

USD/CAD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Furthermore, just as global central banks are reaching an inflection point in the hiking cycle, China cut a few key policy rates in the past week, boosting hopes of more stimulus in coming months to support the fragile economic recovery. Media reports suggest Beijing is considering issuing roughly one trillion yuan of special treasury bonds to help indebted local governments and boost business confidence.

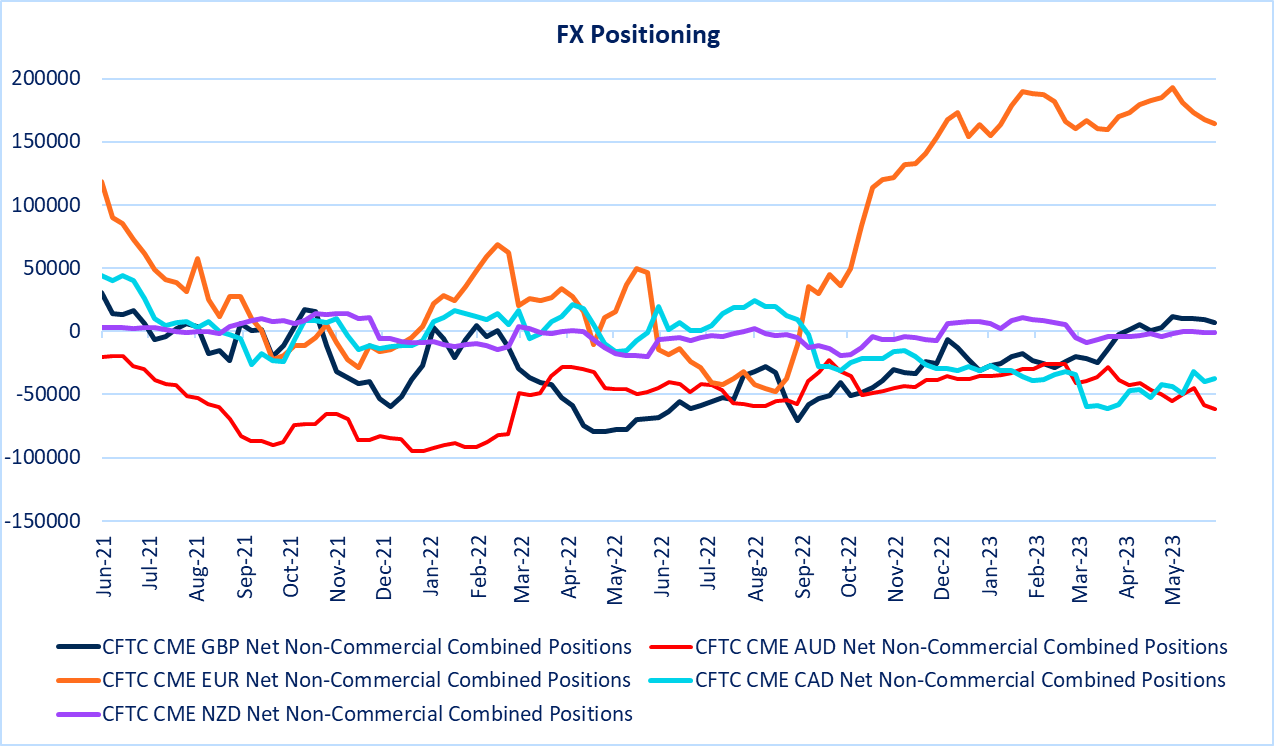

From a monetary policy perspective, there is very little takeaway for USD/CAD. Both the US Federal Reserve and the Bank of Canada aren’t done with tightening, although the extent of such tightening would depend on incoming data. However, stretched speculative short CAD positioning leaves open the possibility of unwinding some of those positions, especially in the absence of a sharp deterioration in global growth.

FX Positioning

Source Data: Bloomberg; Chart created in Microsoft Excel

USD/CAD: Cracks below vital support

USD/CAD’s break below vital converged support around 1.3220-1.3320 has initially opened the gates toward the psychological 1.3000, potentially toward the August low of 1.2725. See the daily chart for potential technical price objectives. From a trend perspective, after being sideways for months, USD/CAD’s fall below the support has reversed the trend to bearish.

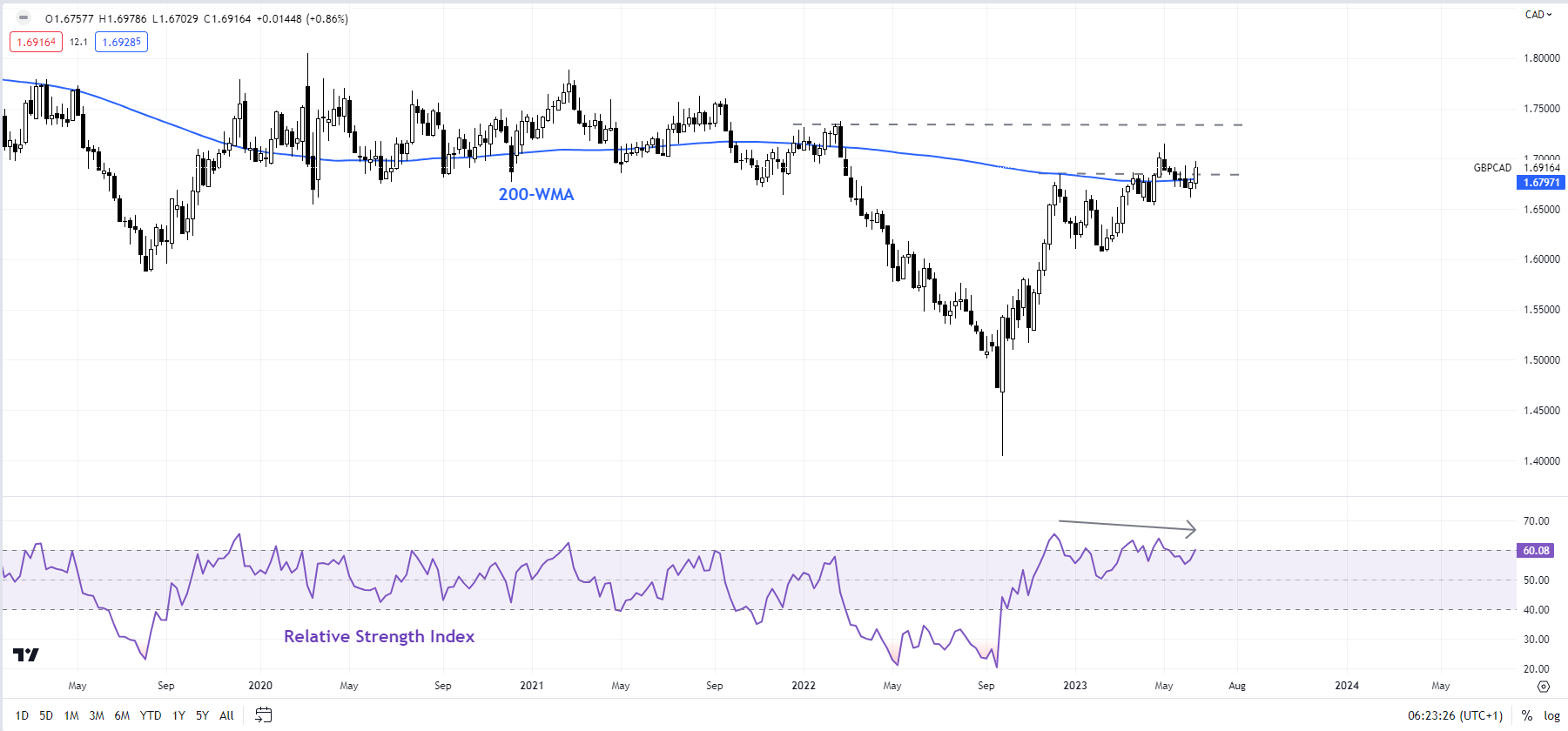

GBP/CAD Weekly Chart

Chart Created Using TradingView

GBP/CAD: Upside capped

GBP/CAD’s failure to rise decisively past the end-2022 high of 1.6850, slightly above major resistance on the 200-week moving average, points to fatigue in the nine-month-long rally. So far, the cross has been supported around a crucial converged floor, including the April low of 1.6535, coinciding with the 89-period moving average. The bias, however, remains down potentially toward the 200-day moving average (now at about 1.6300).

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish