GBP/USD and EUR/GBP Prices, Charts, and Analysis

The British Pound is trading in a positive fashion against a wide range of currencies, boosted by expectations that UK interest rates will continue to move higher in a concerted effort to push down stubbornly high inflation. As interest rate differentials widen in Sterling’s favor, GBP pairs will likely push higher for the foreseeable future.

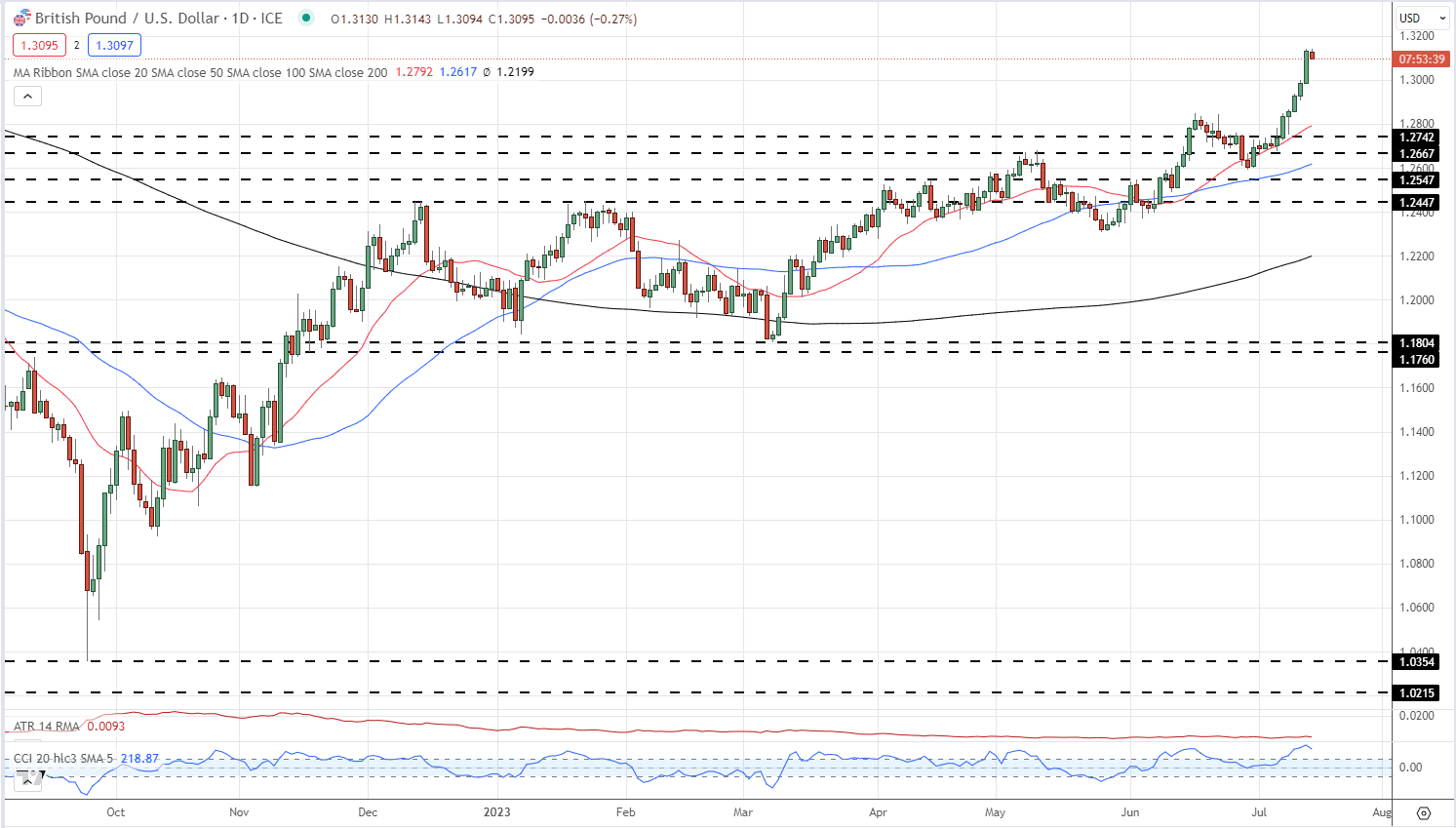

Next Wednesday sees the latest UK inflation report released, and this may change the dynamic. Bank of England governor Andrew Bailey has been saying for months now that UK inflation will soon fall sharply but, as yet, inflation remains high. Headline inflation is seen falling to 8.2% in June from 8.7% in May, while the closely watched core inflation rate is seen unchanged at 7.1%. And deviation lower by one, or both, of these measures, may see Sterling fade lower from its current levels.

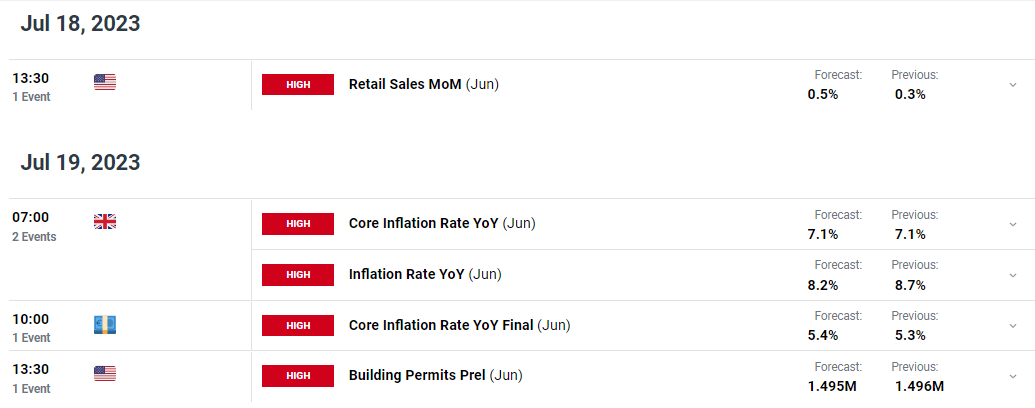

For all market-moving events and data releases see the real-time DailyFX Calendar

GBP/USD is up nearly 27% since late September after ex-PM Liz Truss's economic policies threw Sterling into a tailspin. Around half of GBP/USD’s gains are due to US dollar weakness but GBP strength over the past week has helped force the pair back to levels last seen around 15 months ago. Cable has had its best week since November 2022, and while the daily chart remains positive, the pair are in heavily overbought territory according to the CCI indicator. GBP/USD may well have a short-term consolidation phase ahead of next week’s inflation data.

GBP/USD Daily Price Chart – July 14, 2023

| Change in | Longs | Shorts | OI |

| Daily | -1% | 0% | -1% |

| Weekly | 63% | -32% | -7% |

GBP/USD Retail Traders are Short

Retail trader data show 26.80% of traders are net-long with the ratio of traders short to long at 2.73 to 1.The number of traders net-long is 4.91% lower than yesterday and 29.94% lower than last week, while the number of traders net-short is 5.52% higher than yesterday and 36.30% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

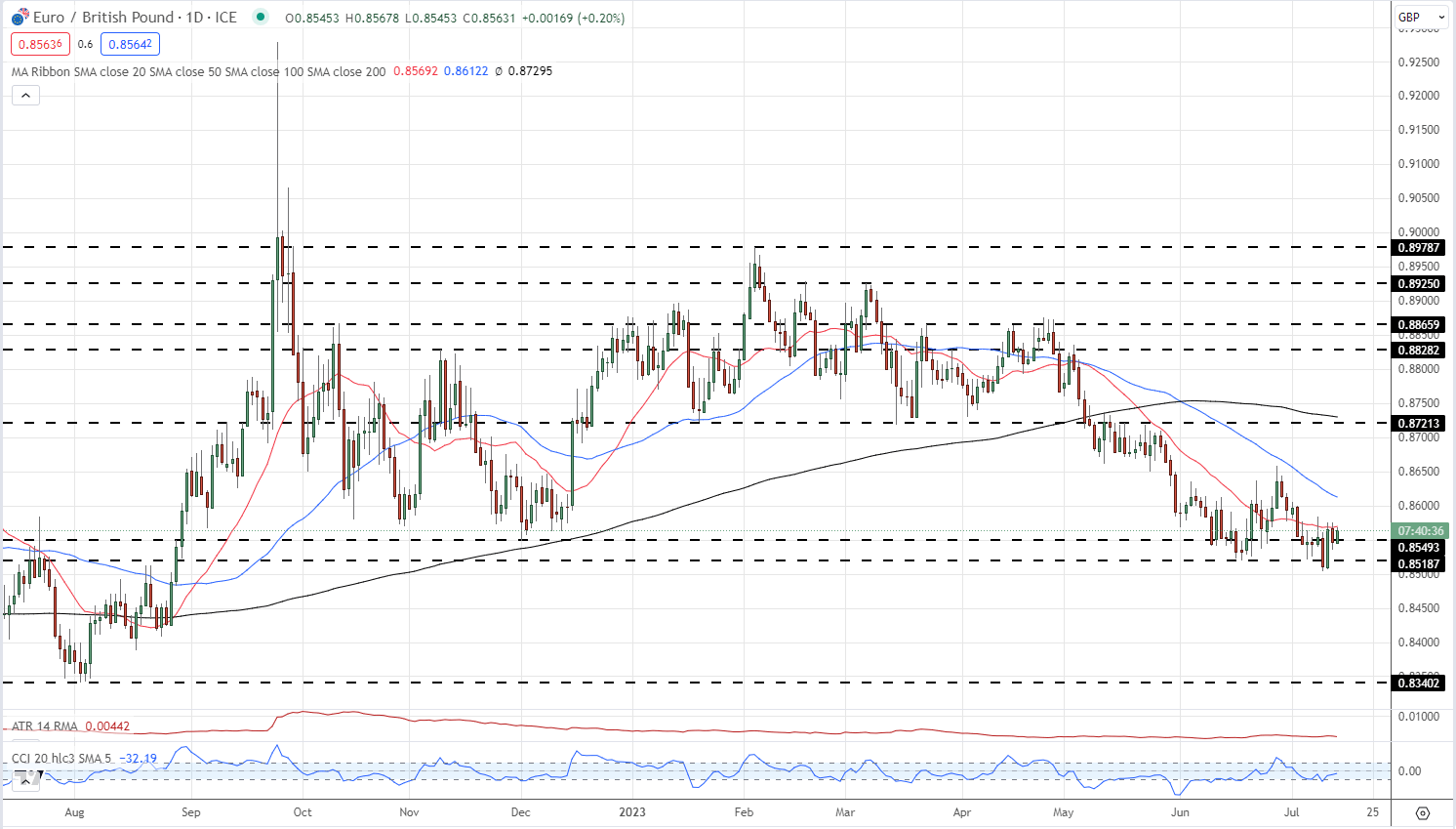

The path of least resistance for EUR/GBP remains lower with the pair making a so far unbroken series of lower highs and lower lows since the early-February high at 0.89787. The pair are now below all three simple moving averages with little in the way of support seen until the August 2nd low at 0.8340.

EUR/GBP Daily Price Chart – July 14, 2023

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.