Market Recap

The usual cautious lead-up to the US consumer price index (CPI) release has failed to deter risk appetite in Wall Street overnight, as major US indices pushed higher on strength in value sectors (energy, industrials, financials). The market confidence could arise as broad expectations are positioned for the upcoming US CPI to reflect further moderation in pricing pressures, with the headline figure expected to decline to 3.1% year-on-year from previous 4%. Likewise, the core aspect is expected to decline to 5.0% year-over-year from 5.3% in May. Month-on-month, both the headline and core inflation prints are expected to increase by 0.3%.

Another dip in the US core CPI read may reinforce some degree of success in Fed’s tightening moves thus far and leaves room for the Fed to consider a prolonged rate pause for more policy flexibility. Any upside surprise in inflation may put chatters of more rate hikes on the table but given that a 25 basis-point (bp) hike is already heavily priced for the upcoming Fed meeting (88% probability from US Fed funds futures) and the broader trend for inflation is still to the downside, it may potentially have to take a significant beat in inflation numbers to drive a pronounced recalibration in rate pricing.

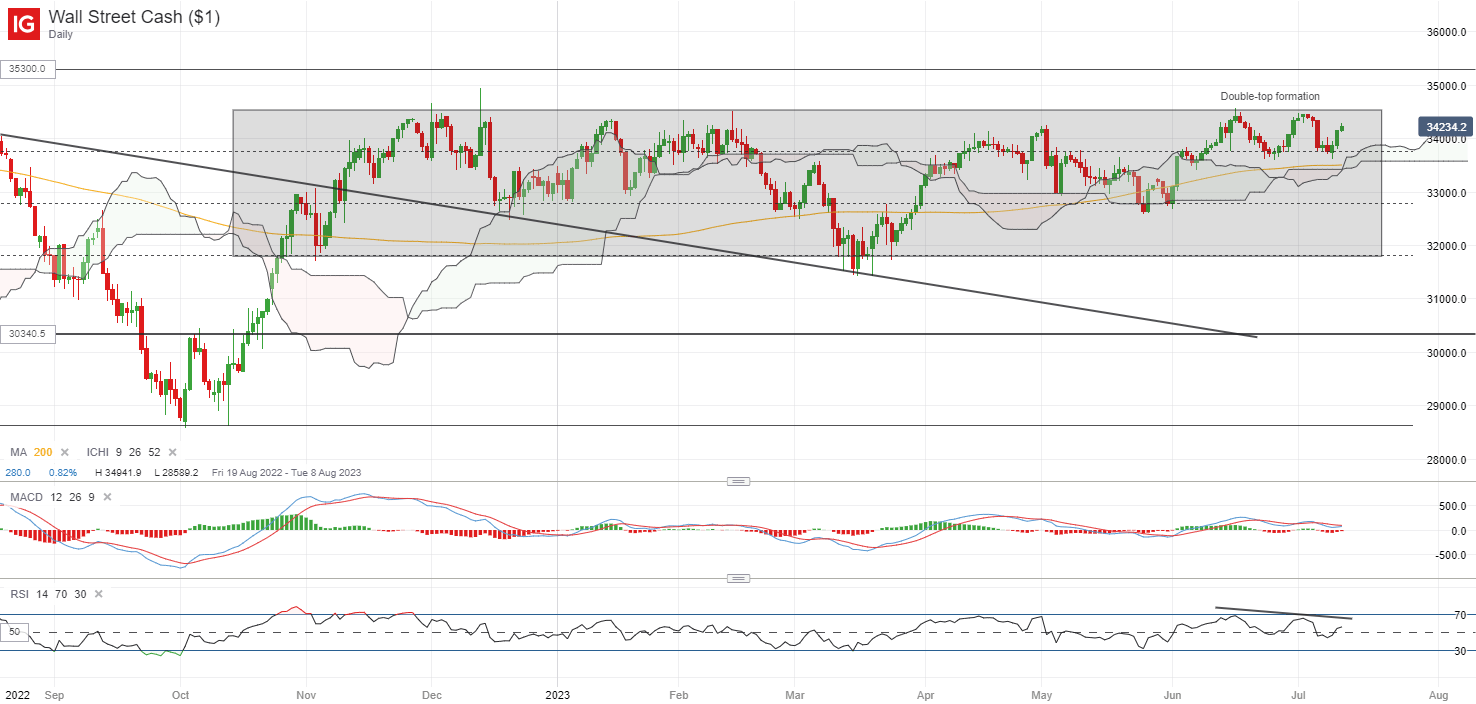

The DJIA has largely traded in a wide consolidation pattern since November last year, with a retest of the upper consolidation range marked with the formation of a double-top pattern. Bearish divergences on Relative Strength Index (RSI) and moving average convergence divergence (MACD) seem to point to moderating upward momentum on recent peaks but nevertheless, buyers have managed to defend the double-top neckline overnight at the 33,600 level. Another retest of the upper range may be on watch at the 34,500 level, with any successful upward break potentially leaving the 35,300 level in sight.

Source: IG charts

Asia Open

Asian stocks are in a mixed session, with Nikkei -0.77%, ASX +0.32% and KOSPI +0.18% at the time of writing. Chinese equities have managed to see some gains yesterday, with the small step from China authorities in extending stimulus support for the property sector providing hopes for more to come over the coming months. The Nasdaq Golden Dragon China Index is up 1.6% overnight after an initial dip. That said, past instances suggest that signs of policy success in lifting economic conditions may still be needed to drive more sustained gains. China’s economic surprise index has turned in a new two-year low recently, with the worst-is-over conditions still on the lookout among investors.

The economic calendar this morning saw a downside surprise in Japan’s producer prices (4.1% versus 4.3% forecast), with its sixth consecutive month of decline seemingly pointing towards some easing upward pressure on consumer prices. With views of a quicker policy shift by the Bank of Japan (BoJ) on the surge in Japanese workers’ wages lately, today’s wholesale inflation data may slightly dampen some hawkish expectations.

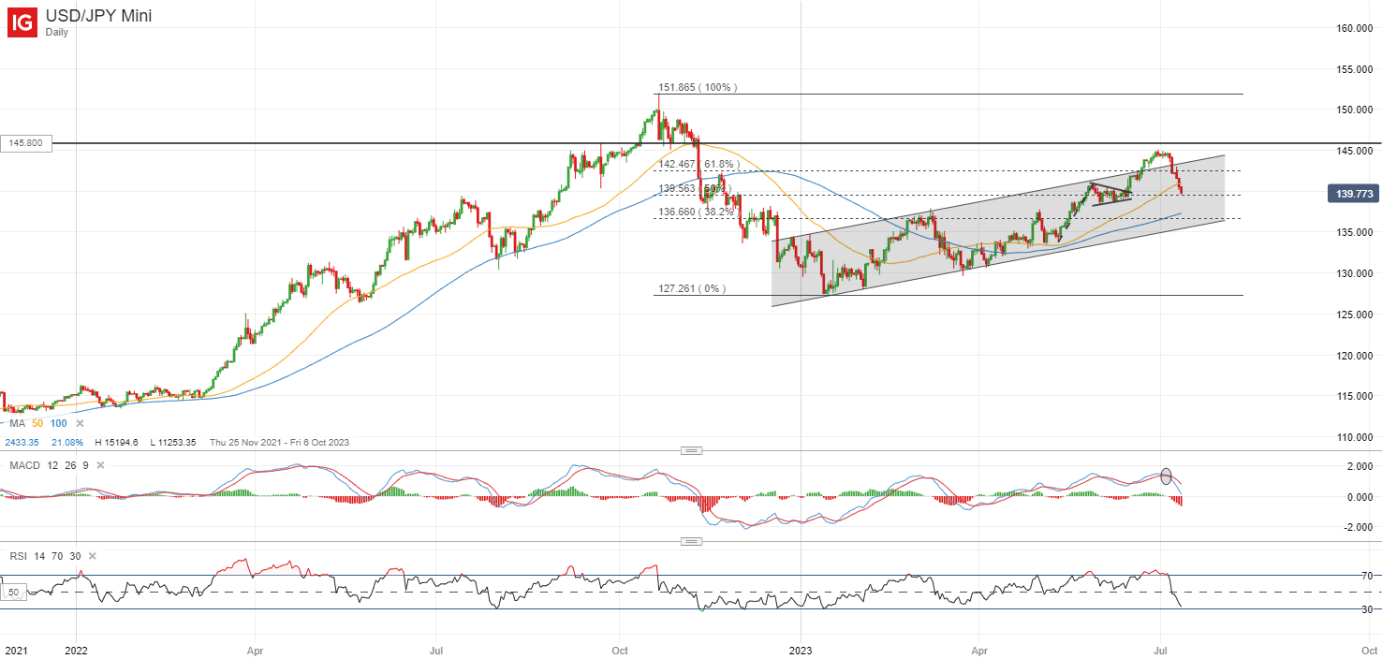

A brief breakout for the USD/JPY above its ascending channel pattern has failed to find much follow-through, as interaction at the 145.00 level was faced with strong resistance. The level marked a previous area of intervention by Japanese authorities, which prompted some retreat from buyers. The pair is currently back to retest its 139.60 level of support, with any failure for the level to hold potentially paving the way towards the 136.60 level, where the lower channel trendline resides.

Source: IG charts

On the watchlist: NZD/USD stuck below resistance confluence

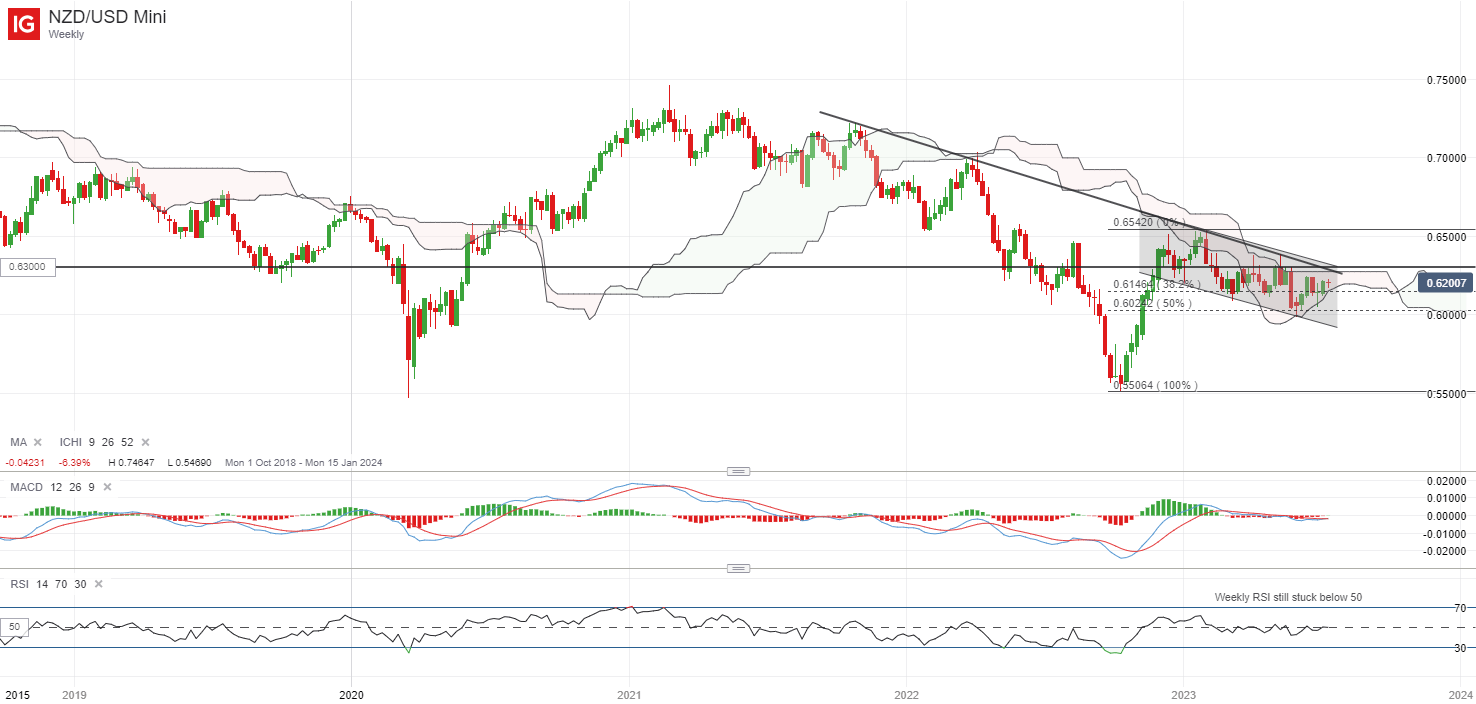

The Reserve Bank of New Zealand (RBNZ) has kept interest rates on hold in today’s meeting as widely expected, considering that 525 bp worth of tightening thus far has forced its economy into a technical recession. While the committee acknowledged that monetary conditions are restricting spending and reducing inflationary pressures, current inflation levels are still too high for comfort, with some lingering bets for an additional hike down the road.

On the weekly chart, the NZD/USD has been trading within a descending channel pattern since the start of the year, with a key resistance confluence at the 0.630 level. This is where the upper channel trendline resistance coincides with the upper edge of the weekly Ichimoku cloud, while its weekly RSI still struggles to overcome its 50 level for now. A reclaim of the 0.630 level may be needed to pave the way to retest its year-to-date high at the 0.654 level next. On the downside, the channel support will place the 0.591 level on watch, if the pair resumes its prevailing downward trend.

Source: IG charts

Tuesday: DJIA +0.93%; S&P 500 +0.67%; Nasdaq +0.55%, DAX +0.75%, FTSE +0.12%